Multiple Choice

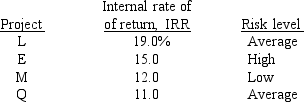

An evaluation of four independent capital budgeting projects by the director of capital budgeting for Ziker Golf Company yielded the following results:  The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

A) Project L

B) Projects L and E

C) Projects L and M

D) Projects L, E, and M

E) None of the above is a correct answer.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Although it is difficult to make accurate

Q53: Assume the following: (1)A firm is considering

Q53: Replacement analysis involves the decision of whether

Q69: With the current techniques available, estimating cash

Q80: Suppose a firm is considering production of

Q83: Mom's Cookies Inc.is considering the purchase of

Q86: Your company must ensure the safety of

Q90: Which of the following is not discussed

Q141: Regarding the net present value of a

Q179: It is extremely difficult to estimate the