Multiple Choice

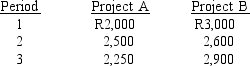

Real Time Systems Inc.is considering the development of one of two mutually exclusive new computer models.Each will require a net investment of R5,000.The cash flow figures for each project are shown below:  Model B, which will use a new type of laser disk drive, is considered a high-risk project, while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

Model B, which will use a new type of laser disk drive, is considered a high-risk project, while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

A) NPVA = R380; NPVB = R1,815.

B) NPVA = R197; NPVB = R1,590.

C) NPVA = R380; NPVB = R1,590.

D) NPVA = R5,380; NPVB = R6,590.

E) None of the above statements is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: In cash flow estimation, the presence of

Q16: Which of the following is not a

Q35: Which of the following statements is correct?<br>A)

Q37: In theory, the decision maker should view

Q39: Exhibit 10-1<br>You have been asked by the

Q41: A firm is evaluating a new machine

Q43: If the firm is being operated so

Q60: Sensitivity analysis is a risk analysis technique

Q100: When evaluating the cash flows associated with

Q160: Using the same risk-adjusted discount rate to