Multiple Choice

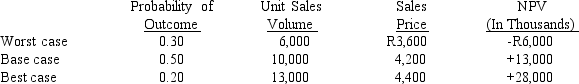

Klott Company encounters significant uncertainty with its sales volume and price in its primary product.The firm uses scenario analysis in order to determine an expected NPV, which it then uses in its budget.The base case, best case, and worst case scenarios and probabilities are provided in the table below.What is Klott's expected NPV, standard deviation of NPV, and coefficient of variation of NPV?

A) Expected NPV = R35,000; NPV = 17,500; CVNPV = 2.0.

B) Expected NPV = R35,000; NPV = 11,667; CVNPV = 0.33.

C) Expected NPV = R10,300; NPV = 12,083; CVNPV = 1.17.

D) Expected NPV = R13,900; NPV = 8,476; CVNPV = 0.61.

E) Expected NPV = R10,300; NPV = 13,900; CVNPV = 1.35.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following statements concerning cash

Q18: A particular project might have very uncertain

Q49: If a firm uses its weighted average

Q56: Which of the following statements is correct?<br>A)

Q57: Exhibit 10-1<br>You have been asked by the

Q61: The Unlimited, a national retailing chain, is

Q62: Corporate risk does not take into consideration

Q63: Whitney Crane Inc.has the following independent investment

Q65: Exhibit 10-1<br>You have been asked by the

Q88: When evaluating a new project,the firm should