Multiple Choice

Table 29-1

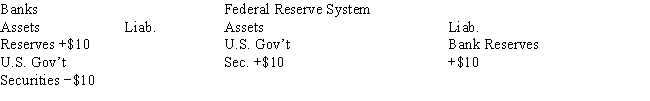

Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars)

-After the transaction in Table 29-1 is completed, what happens to actual reserves, required reserves, and excess reserves? Assume the required reserve ratio is 25 percent.

A) Actual reserves increase by $10 million, required reserves increase $2.5 million, and excess reserves increase by $7.5 million.

B) Actual reserves decrease by $10 million, required reserves decrease $2.5 million, and excess reserves decrease by $7.5 million.

C) Actual reserves increase by $10 million, required reserves are unchanged, and excess reserves increase by $10 million.

D) Actual reserves decrease by $10 million, required reserves decrease by $10 million, and excess reserves are unchanged.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: A decrease in the reserve requirements causes<br>A)reserves

Q67: Open-market operations is the purchase and sale

Q68: Stock prices fell throughout much of 2007

Q69: Which of the following would indicate that

Q70: If the Fed's open-market operations expand the

Q72: Which of the following is most sensitive

Q73: What is the federal funds rate? What

Q74: Open-market operations have their initial effect on

Q75: If the Fed sells a U.S.Treasury bill

Q76: If banks choose to hold excess reserves<br>A)Lending