Multiple Choice

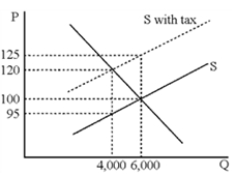

Figure 18-2

-Figure 18-2 shows the widget market before and after an excise tax is imposed.What percentage of the tax per widget is borne by consumers, considering the true economic incidence of the tax?

A) 0 percent

B) 20 percent

C) 50 percent

D) 80 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q41: If a tax is proportional, the average

Q42: For about the past 45 years, state

Q43: Which of the following is not true

Q44: If demand is more elastic, the portion

Q45: Which of the following is not true

Q47: Taxation can promote good social policy while

Q48: The corporate tax applies to firms' total

Q49: Which is not a significant source of

Q50: Suppose Mishka buys 15 apples per month

Q51: The payroll tax is a direct tax.