Multiple Choice

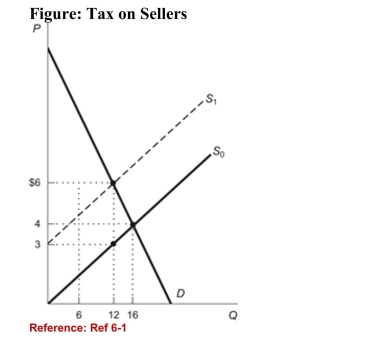

(Figure: Tax on Sellers) Suppose the imposition of a per-unittax on sellers shifts the supply curve from S0 to S1. Using thefigure, calculate the amount of the tax.

(Figure: Tax on Sellers) Suppose the imposition of a per-unittax on sellers shifts the supply curve from S0 to S1. Using thefigure, calculate the amount of the tax.

A) $1

B) $2

C) $3

D) $4

Correct Answer:

Verified

Correct Answer:

Verified

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Commodity Tax

Q29: Figure: Demand and Supply with Subsidy <img

Q31: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Tax on

Q32: Figure: Wage Subsidy <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt="Figure: Wage

Q33: If the elasticity of demand is 1

Q34: Suppose the demand for pizza is inelastic

Q35: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Consumer and

Q65: Which of the following statements is TRUE?

Q69: Taxes lead to a loss of beneficial

Q123: Which of the following statements is TRUE?