Multiple Choice

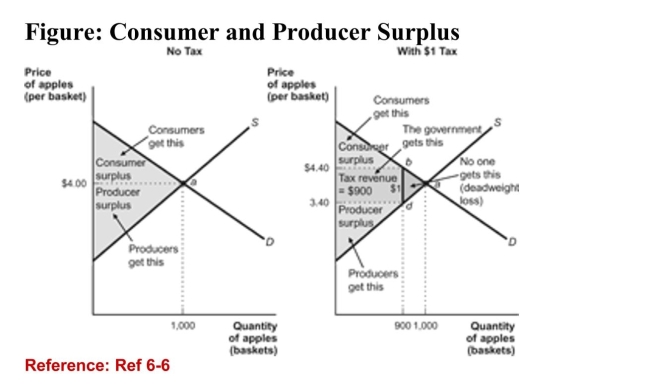

(Figure: Consumer and Producer Surplus) According to thefigure, what would happen to the deadweight loss if the taxincreased to $2 per basket of apples?

(Figure: Consumer and Producer Surplus) According to thefigure, what would happen to the deadweight loss if the taxincreased to $2 per basket of apples?

A) The new tax would minimize deadweight loss.

B) Deadweight loss does not change due to a change in the tax.

C) There is no way to tell what will happen to deadweight loss.

D) Deadweight loss will increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Imposition of

Q5: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Tax on

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Tax Imposed

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Figure: Supply and

Q11: (Figure: Commodity Tax with Elastic Demand) According

Q35: Whether a buyer or a seller pays

Q60: A tax on the seller of a

Q98: Which of the following is a correct

Q183: Suppose that there is a tax of

Q189: Which of the following statements is TRUE?<br>I.