Multiple Choice

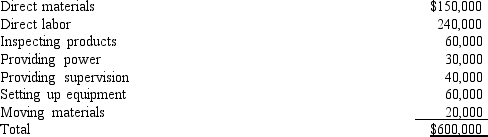

Foster Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $90,000 decrease

D) $90,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Teller Company has designed a caller ID

Q36: Many companies start with cost to determine

Q37: In deciding the optimal mix of products

Q79: A decision that involves potential further processing

Q92: When managers are considering the optimal product

Q94: Refer to Figure 13-3. What is the

Q103: The operations of Smits Corporation are divided

Q110: Rose Manufacturing Company had the following unit

Q125: Flexible resources may have unused capacity.

Q128: Which of the following costs is not