Essay

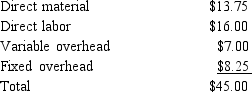

Tapeo Company has always made its electronic components that go into their GPS systems in-house. Streeter Company has offered to supply these electronic components at a price of $38 each. Tapeo uses 18,000 units of these components each year. The cost per unit of this component is as follows:

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Required:

A. If Tapeo decided to purchase the electronic component from Streeter Company how much would its operating income increase or decrease?

B. Should Tapeo continue to make the electronic component or buy it from Streeter Company?

Correct Answer:

Verified

A.

B. Tapeo should...

B. Tapeo should...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Manning Company uses a joint process to

Q18: Victor's Detailing customers would be willing to

Q20: David Company produces two types of gears,

Q45: The solution of the product mix problem

Q114: Matching<br><br>Match each statement with the correct item

Q118: Welker Company is designing an all-in-one grill

Q143: Matching<br><br>Match each statement with the correct item

Q145: A method of determining the cost of

Q160: Qualitative factors that should be considered when

Q166: Refer to Figure 13-4. How many of