Essay

Figure 16-2.

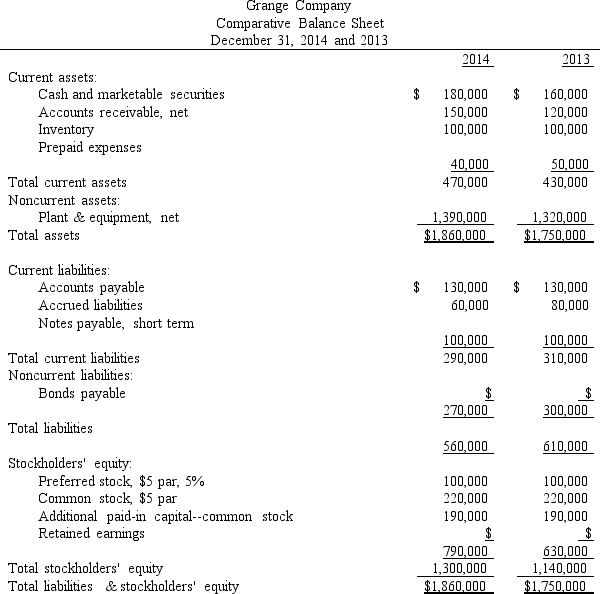

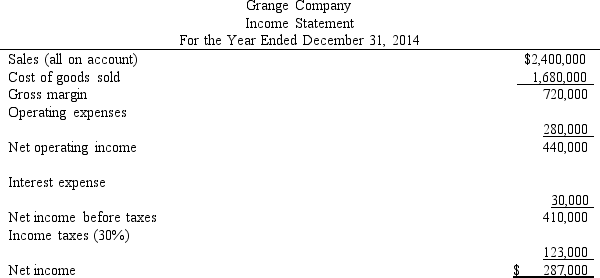

Financial statements for Grange Company appear below:

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.

The market price of a share of common stock on December 31, 2014, was $100.

-Refer to Figure 16-2.

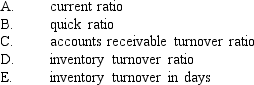

Required: Compute the following liquidity ratios for 2014:

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Eagle Company has $9,000 in cash, $11,000

Q8: The Gift Shoppe's inventory turned over five

Q10: Figure 16-2.<br>Financial statements for Grange Company appear

Q11: Data concerning Bouerneuf Company's common stock follow:

Q77: Which one of the following would not

Q102: The _ is calculated by dividing the

Q137: Opis Company has total assets of $475,000

Q142: Many industrial averages and figures are published

Q151: A liquidity ratio measures the<br>A) income or

Q185: Horizontal analysis is analysis<br>A) of percentage changes