Essay

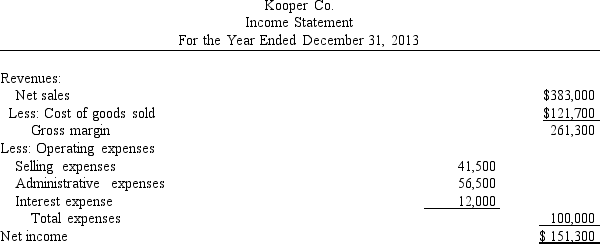

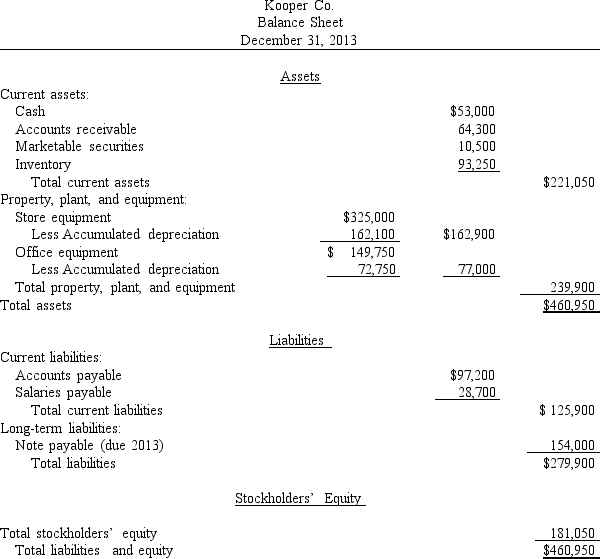

Figure 16-7

There were 30,000 shares of common stock outstanding throughout 2013. Dividends on common stock amounted to $21,000 and dividends on preferred stock amounted to $30,000. The market value of a share of common stock was $36 at the end of 2013. The income tax rate is 40%. The accounts receivable and inventory accounts had beginning balances of $58,500 and $101,400 respectively. Total assets at the beginning of the year were $430,500.

There were 30,000 shares of common stock outstanding throughout 2013. Dividends on common stock amounted to $21,000 and dividends on preferred stock amounted to $30,000. The market value of a share of common stock was $36 at the end of 2013. The income tax rate is 40%. The accounts receivable and inventory accounts had beginning balances of $58,500 and $101,400 respectively. Total assets at the beginning of the year were $430,500.

-Refer to Figure 16-7.

Required: Calculate the following ratios:

A. Debt ratio

B. Debt-to-equity ratio

State what information each ratio is providing to the company.

Correct Answer:

Verified

The debt ratio is 0.61, which means tha...

The debt ratio is 0.61, which means tha...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: _ expresses a line item as a

Q77: Indicate the type of each ratio listed

Q77: If a company has an acid-test ratio

Q93: Investors who prefer gains through appreciation will

Q95: Last year Fuller Company had a net

Q97: Last year the return on total assets

Q99: Figure 16-2.Financial statements for Grange Company appear

Q100: Miller Company had $120,000 in sales on

Q102: Which one of the following is not

Q149: Which profitability ratio requires the use of