Essay

Figure 12-8

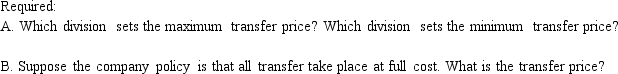

Bostonian Inc. has a number of divisions, including Delta Division and ListenNow Division. The ListenNow Division owns and operates a line of MP3 players. Each year the ListenNow Division purchases component AZ in order to manufacture the MP3 players. Currently it purchases this component from an outside supplier for $6.50 per component. The manager of the Delta Division has approached the manager of the ListenNow Division about selling component AZ to the ListenNow Division. The full product cost of component AZ is $3.10. The Delta Division can sell all of the components AZ it makes to outside companies for $6.50. The ListenNow Division needs 18,000 component AZs per year; the Delta Division can make up to 60,000 components per year.

-Refer to Figure 12-8.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The Balanced Scorecard perspective that defines the

Q18: If the selling division is operating at

Q19: Typically, investment centers are evaluated on the

Q30: Economic value added is just a specific

Q42: In calculating residual income, the minimum rate

Q48: Several transfer pricing policies are used in

Q56: Division A produces a component and wants

Q93: If there is a competitive outside market

Q127: In negotiated transfer pricing, the buying division

Q142: Given the following information for the Reardon