Essay

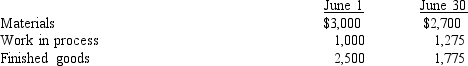

In June, Olympic Company purchased materials costing $38,000, and incurred direct labor cost of $42,000. Overhead totaled $27,000 for the month. Information on inventories was as follows.

Required:

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Select the appropriate definition for each of

Q36: Select the appropriate classification of the output

Q41: Allocation means that an indirect cost is

Q54: Operating income equals<br>A) sales revenue - cost

Q68: Expired costs are called _.

Q119: Fidalgo Company makes stereos. During the year,

Q121: Rizzuto Company supplied the following information for

Q140: Figure 2-7.Gateway Company produces a product

Q181: Employees who convert direct materials into a

Q196: Select the appropriate definition for each of