Multiple Choice

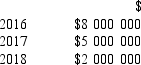

On 1 January 2016, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

A) $800 000

B) $2 000 000

C) $3 200 000

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under which of the following circumstances would

Q2: Highrise Constructions Ltd had a large three-year

Q3: Leslie Ltd has found an error in

Q4: Revenue from a credit sale should not

Q6: Toy Company manufactures toy koalas. Transactions for

Q7: Multi-Storey Builders Ltd had a large three-year

Q8: The profit for a particular project of

Q9: Which of the following transactions should not

Q10: Junction Company had the following transactions, among

Q11: Leslie Ltd has found an error in