Multiple Choice

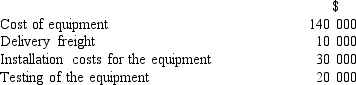

A company purchases equipment on 1 January 2019. The following costs are incurred:  The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

A) $28 000

B) $36 000

C) $40 000

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When a company discards machinery that is

Q11: On 1 January 2018, a new motor

Q12: Where there is an asset revaluation decrement

Q13: Bully Ltd acquires all the business assets

Q14: A used machine with a purchase price

Q16: Which of the following should NOT be

Q17: The purpose of depreciation is to:<br>A) allocate

Q18: Which method can result in annual depreciation

Q19: Equipment with a cost of $15 000

Q20: Which of the following would be included