Essay

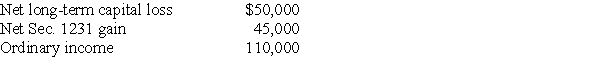

Tracy has a 25% profit interest and a 20% loss interest in the Dupont Partnership. The Dupont Partnership reports the following income and loss items for the current year:  What is Tracy's distributive share?

What is Tracy's distributive share?

Correct Answer:

Verified

The partnership has a $105,000 ($110,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Miguel has a 50% interest in partnership

Q2: Albert contributes a Sec. 1231 asset to

Q3: Yee manages Huang real estate, a partnership

Q5: The partners of the MCL Partnership, Martin,

Q6: Jangyoun sells investment land having a $30,000

Q7: Charles Jordan files his income tax return

Q8: Identify which of the following statements is

Q9: Identify which of the following statements is

Q10: On January 1, Helmut pays $2,000 for

Q11: Janice has a 30% interest in the