Multiple Choice

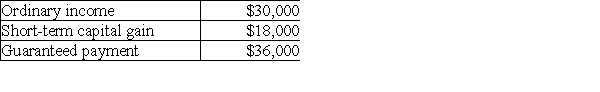

Brent is a general partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: Which of the following is false?<br>A)A large

Q41: A partner's basis for his or her

Q42: Clark and Lewis are partners who share

Q43: Bao had investment land that he purchased

Q44: On January 2 of the current year,

Q46: Rashad contributes a machine having a basis

Q47: Victor and Kristina decide to form VK

Q48: Identify which of the following statements is

Q49: What is the tax impact of guaranteed

Q50: Identify which of the following statements is