Multiple Choice

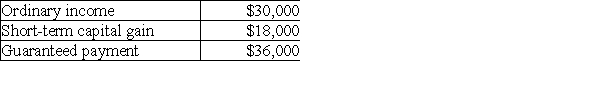

Brent is a limited partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Identify which of the following statements is

Q58: Jane contributes land with an FMV of

Q59: Mario contributes inventory to a partnership on

Q60: No gain is recognized on the sale

Q61: Bob contributes cash of $40,000 and Carol

Q63: Bud has devoted his life to his

Q64: Dan purchases a 25% interest in the

Q65: What is included in partnership taxable income?

Q66: In computing the ordinary income of a

Q67: Identify which of the following statements is