Multiple Choice

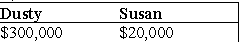

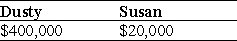

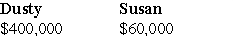

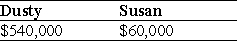

Dusty Corporation owns 90% of Palace Corporation's stock and Susan owns the remaining stock. Dusty Corporation's stock basis is $300,000 and Susan's stock basis is $20,000. Under a plan of complete liquidation, Dusty Corporation receives property with a $400,000 adjusted basis and a $540,000 FMV and Susan receives property with a $20,000 adjusted basis and a $60,000 FMV. The bases of the properties are:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Generally, a corporation recognizes a gain, but

Q34: Bluebird Corporation owns and operates busses and

Q35: In a Sec. 332 liquidation, what bases

Q36: What attributes of a controlled subsidiary corporation

Q37: Identify which of the following statements is

Q39: When a subsidiary corporation is liquidated into

Q40: The stock of Cooper Corporation is 70%

Q41: A liquidation must be reported to the

Q42: Why should a corporation that is 100%

Q43: A corporation is required to file Form