Multiple Choice

Prime Corporation liquidates its 85%-owned subsidiary Bass Corporation under the provisions of Secs. 332 and 337. Bass Corporation distributes land to its minority shareholder, John, who owns a 15% interest. The property received by John has a $55,000 FMV. The land was used in the Bass Corporation's business and has a $65,000 adjusted basis and is subject to a $10,000 liability, which is assumed by John. John's basis in his stock is $25,000. What gain or loss will John and Bass Corporation recognize on the distribution of the land?

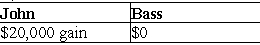

A)

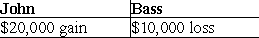

B)

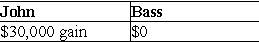

C)

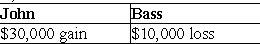

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Identify which of the following statements is

Q13: Under the general liquidation rules, Missouri Corporation

Q14: If a liquidating subsidiary corporation primarily has

Q15: Cowboy Corporation owns 90% of the single

Q16: Parent Corporation, which operates an electric utility,

Q18: What are the differences, if any, in

Q19: When a corporation liquidates, it performs three

Q20: A subsidiary must recognize depreciation recapture income

Q21: Parent Corporation owns 70% of Sam Corporation's

Q22: Parent Corporation owns 100% of the single