Multiple Choice

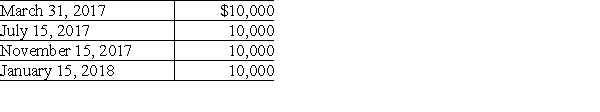

Sandy, a cash method of accounting taxpayer, has a basis of $46,000 in her 500 shares of Newt Corporation stock. She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31, 2017. What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31, 2017. What are the tax consequences of the distributions?

A) Sandy will recognize a loss of $4,500 in 2017 and a $1,500 loss in 2018.

B) Sandy will recognize the entire loss in 2017.

C) Sandy will recognize the entire loss in 2018.

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: During 2017, Track Corporation distributes property to

Q65: Parent Corporation owns all of Subsidiary Corporation's

Q66: The general rule for tax attributes of

Q67: Riverwalk Corporation is liquidated, with Juan receiving

Q68: The liquidation of a subsidiary corporation must

Q70: Identify which of the following statements is

Q71: Santa Fe Corporation adopts a plan of

Q72: Parent Corporation for ten years has owned

Q73: How is the gain/loss calculated if a

Q74: Greg, a cash method of accounting taxpayer,