Multiple Choice

Homewood Corporation adopts a plan of liquidation on June 15 and shortly thereafter sells a parcel of land on which it realizes a $50,000 gain (excluding the effects of a $5,000 sales commission) . Homewood pays its legal counsel $2,000 to draft the plan of liquidation. The accountant fees for the liquidation are $1,000, which are also paid during the year. What is Homewood Corporation's realized gain on the sale of land and deductible liquidation expenses?

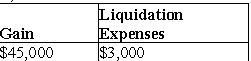

A)

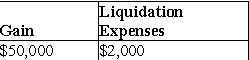

B)

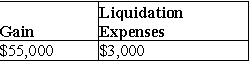

C)

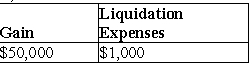

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Mary receives a liquidating distribution from Snell

Q2: Are liquidation and dissolution the same? Explain

Q3: What event determines when a cash or

Q5: Market Corporation owns 100% of Subsidiary Corporation's

Q6: A plan of liquidation must be reduced

Q7: Albert receives a liquidating distribution from Glidden

Q8: A plan of liquidation<br>A)must be written.<br>B)details the

Q9: A subsidiary recognizes no gain or loss

Q10: Lake City Corporation owns all of the

Q11: Texas Corporation is undergoing a complete liquidation