Multiple Choice

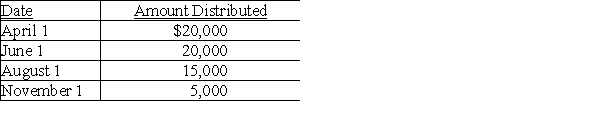

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax-free as a return of capital.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Marie owns one-half of the stock of

Q57: Alice owns 56% of Daisy Corporation's stock

Q58: Identify which of the following statements is

Q59: Poppy Corporation was formed three years ago.

Q60: Wills Corporation, which has accumulated a current

Q62: Corporations may always use retained earnings as

Q63: Which of the following statements is not

Q64: Current E&P does not include<br>A)tax-exempt interest income.<br>B)life

Q65: Crossroads Corporation distributes $60,000 to its sole

Q66: Elijah owns 20% of Park Corporation's single