Essay

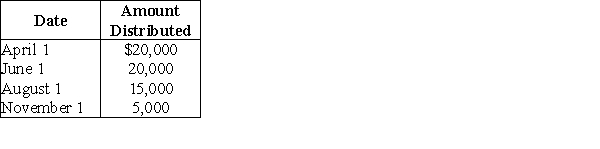

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000. During the year, the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

Correct Answer:

Verified

The current E&P is allocated ratably to ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Identify which of the following statements is

Q20: A corporation distributes land and the related

Q21: A stock redemption is always treated as

Q22: Joshua owns 100% of Steeler Corporation's stock.

Q23: Identify which of the following statements is

Q25: White Corporation is a calendar-year taxpayer. Wilhelmina

Q26: Strong Corporation is owned by a group

Q27: Peter owns all 100 shares of Parker

Q28: Van owns all 1,000 shares of Valley

Q29: On April 1, Delta Corporation distributes $120,000