Multiple Choice

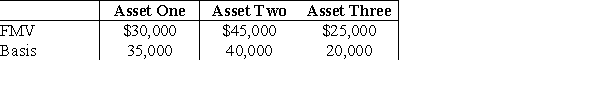

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec. 351.  Max's recognized gain is

Max's recognized gain is

A) $3,000.

B) $5,000.

C) $7,000.

D) $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q85: Beth transfers an asset having an FMV

Q86: Discuss the impact of the contribution of

Q87: Which of the following is an advantage

Q88: Silvia transfers to Leaf Corporation a machine

Q89: Darnell, who is single, exchanges property having

Q91: Abby owns all 100 shares of Rent

Q92: Cherie transfers two assets to a newly-created

Q93: Jerry transfers two assets to a corporation

Q94: Jeremy transfers Sec. 351 property acquired three

Q95: Nathan is single and owns a 54%