Multiple Choice

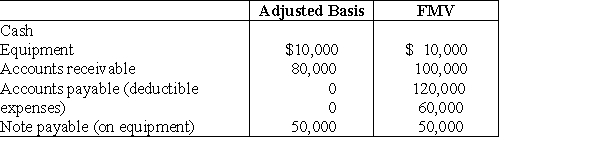

Martin operates a law practice as a sole proprietorship using the cash method of accounting. Martin incorporates the law practice and transfers the following items to a new, solely owned corporation.  Martin must recognize a gain of ________ and has a stock basis of ________:

Martin must recognize a gain of ________ and has a stock basis of ________:

A) $0; $30,000

B) $0; $40,000

C) $20,000; $30,000

D) $20,000; $40,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Chris transfers land with a basis of

Q3: The assignment of income doctrine does not

Q4: Norman transfers machinery that has a $45,000

Q5: For the last four years, Bob and

Q6: In accordance with the rules that apply

Q7: A shareholder's basis in stock received in

Q8: Maria has been operating a business as

Q9: In which of the following independent situations

Q10: If a corporation's total adjusted bases for

Q11: In January of the current year, Rae