Multiple Choice

Yenhung, who is single, forms a corporation using a tax-free asset transfer, which qualifies under Sec. 351. She contributes property having an adjusted basis of $50,000 and an FMV of $40,000. The stock received from the corporation is Sec. 1244 stock. When Yenhung sells the stock for $30,000, her loss is

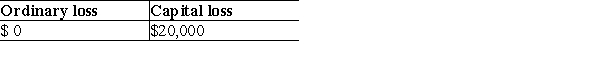

A)

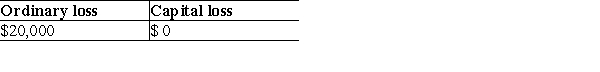

B)

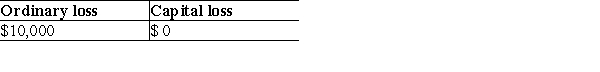

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Identify which of the following statements is

Q58: Carolyn transfers property with an adjusted basis

Q59: The City of Springfield donates land worth

Q60: Carmen and Marc form Apple Corporation. Carmen

Q61: Jermaine owns all 200 shares of Peach

Q63: Sarah transfers property with an $80,000 adjusted

Q64: Upon formation of a corporation, its assets

Q65: The transferor's basis for any noncash boot

Q66: Identify which of the following statements is

Q67: Demarcus is a 50% partner in the