Multiple Choice

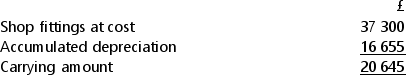

Darlene depreciates shop fittings on a reducing balance basis at 25% each year.At her 31 December 20X4 year end the balances included in non-current assets in respect of shop fittings were:  On 1 January 20X5, Darlene bought more shop fittings at a cost of £9650.She did not dispose of any shop fittings during the year.

On 1 January 20X5, Darlene bought more shop fittings at a cost of £9650.She did not dispose of any shop fittings during the year.

What was the depreciation charge in respect of Darlene's shop fittings in the year ended 31 December 20X5 (to the nearest £) ?

A) £6576

B) £7574

C) £11 737

D) £19 067

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Trish runs a boxing club.She installed a

Q20: Ellie buys a new delivery vehicle on

Q21: On 31 December 20X4 Oksana's statement of

Q22: Amie sells a motor vehicle for £6000.The

Q23: On 1 January 20X4 Solway Pharma Limited

Q24: Kevin disposed of a non-current asset on

Q25: Norman runs a storage facility in which

Q27: Which one of the following statements about

Q28: Molly buys a new cash till on

Q29: Griff runs a dance studio.Early in 20X1