Essay

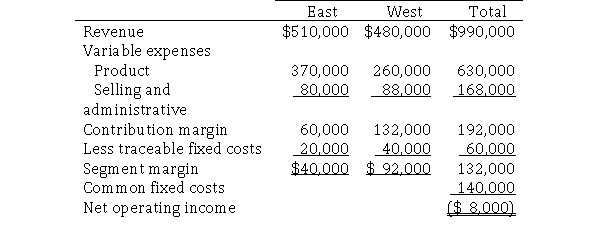

Nobles Corporation provided the following segment margin income statement for two of its divisions: East and West.  Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Required:

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Correct Answer:

Verified

a.EVA calculations for East and West:

Ea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ea...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: In calculating ROI, the return on investment

Q59: The formula to calculate EVA is<br>A)Net operating

Q60: The segment margin income statement excludes<br>A)all allocated

Q61: What is a transfer price? List the

Q62: Bethel Corporation provided the following income statement

Q64: In calculating EVA, invested capital is the

Q65: Blanco Corporation's Cajun Spice division has a

Q66: The organizational structure in which decision-making authority

Q67: Jumbo Industries is considering the purchase of

Q68: Which of the following is the most