Essay

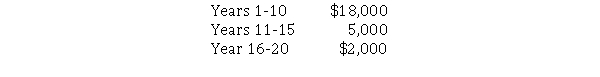

Birch manufacturing is considering the addition of another product line to its offerings.Equipment needed to produce the new line will cost $200,000.Birch estimates that the net annual cash inflows from the new product line will be as follows:  Required:

Required:

a.What is the payback period for the new product line?

b.If the company can establish a steady customer base before production starts and the cash inflows will be $15,000 per year for years 1 - 15, with years 16 through 20 remaining at $2,000 annually, what will be the payback period?

Correct Answer:

Verified

a.$18,000 × 10 = $180,000; $20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Jodi Jarvis won a $10 million lottery

Q2: Which of the following is not a

Q3: Lorman Manufacturing purchases equipment with an expected

Q4: Which of the following is not a

Q6: All capital assets are depreciable assets.

Q7: Using the payback method to evaluate capital

Q8: Welcher, Inc.plans to purchase equipment with a

Q9: The payback period is the time it

Q10: The payback period is used most often

Q11: Mauldin Welding Shop is considering the purchase