Essay

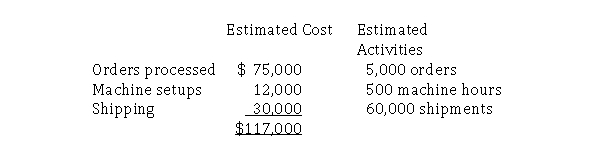

Jones Manufacturing Company makes two products.In the past, the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders, machine setups, and good shipped.The following is a summary of company information:  Required:

Required:

a.Calculate the company's overhead rate using a single cost pool.

b.Calculate the company's overhead rates using the activity-based costing pools.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: In an activity-based costing system, which of

Q30: Auburn, Inc.'s overhead costs of $700,000 consist

Q31: Which of the following might be a

Q32: Customer-level activities are also referred to as

Q33: Activity-based costing information may be used by

Q35: Product-level activities are also referred to as

Q36: Product-level activities are also referred to as<br>A)product-sustaining

Q37: Calculating the direct materials and direct labor

Q38: Which of the following is the most

Q39: Inspection is classified as value-added in which