Essay

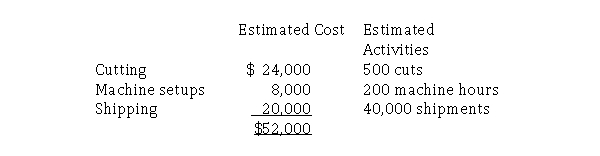

Clover Manufacturing Company makes two products.Using the traditional allocation method, the company has allocated overhead based on estimated total direct labor cost of $125,000.Clover recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: cutting, machine setups, and shipping.The following is a summary of company information:  Required:

Required:

a.Calculate the company's overhead rate as a percentage of direct labor cost.

b.Calculate the company's overhead rates using the activity-based costing pools.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Turnbull Company produces two products and their

Q11: Which of the following is considered a

Q12: The greatest use of activity-based costing information

Q13: Ayala Inc.computed an overhead rate for machining

Q14: Activities that support the products or services

Q16: Identifying activities performed in the organization is

Q17: Assume that activity cost totals $180,000.The company

Q18: Since a batch-level activity is based on

Q19: Activity-based costing information can be used to

Q20: Which of the following is considered a