Essay

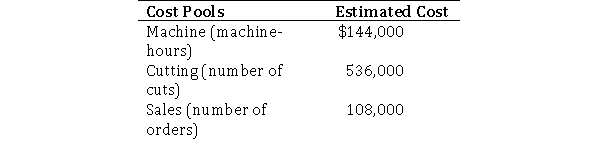

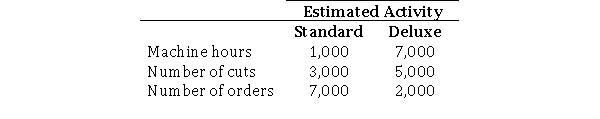

Angora, Inc.uses activity-based costing to cost its two products: Standard and Deluxe.The company has provided the following data relating to its activities:

Required:

Required:

a.What is the activity rate for the cutting cost pool?

b.If actual activity is the same as that estimated, what is the total amount of overhead cost allocated to the Standard product?

Correct Answer:

Verified

Correct Answer:

Verified

Q128: A firm produces and sells two products,

Q129: Assigning manufacturing overhead cost to activity pools

Q130: Activity-based costing did not gain widespread popularity

Q131: The examination of business processes to identify

Q132: Those activities that create the product the

Q134: In changing from a traditional costing system

Q135: The process of using activity-based costing information

Q136: The following list includes activities that are

Q137: Place an "X" in the column that

Q138: Austin Company manufactures 2 products, Flacca and