Related Questions

Q10: The entry to record the receipt of

Q11: Freight costs incurred by the seller on

Q12: Financial information is presented below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8266/.jpg"

Q14: At the beginning of September, 2011, GLF

Q18: In the Clark Company, sales were $320,000,

Q154: Operating expenses are different for merchandising and

Q172: IFRS requires a single-step income statement, but

Q187: In a perpetual inventory system cost of

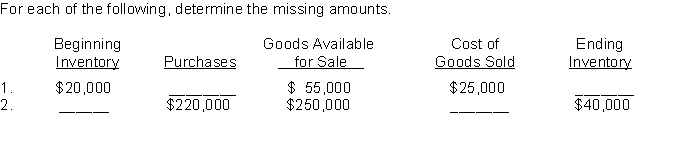

Q202: Cost of goods available for sale is

Q212: Company X sells $400 of merchandise on