Essay

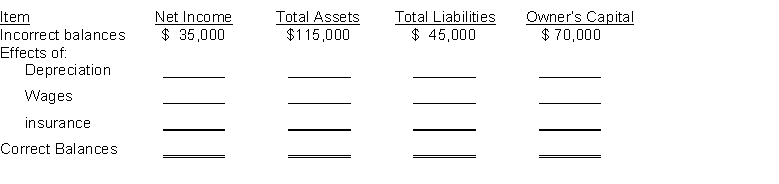

On December 31, 2022, Fashion Nugget Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $35,000. The balance sheet showed total assets, $115,000; total liabilities, $45,000; and owner's capital, $70,000.

The data for the three adjusting entries were:

(1) Depreciation of $10,000 was not recorded on equipment.

(2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded. The next payroll will (3) Insurance of $12,000 was paid for two months in advance on December 1. The entire amount was debited to Insurance Expense when paid.

Instructions

Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses):

Correct Answer:

Verified

[Net inc: (Incorrect bal. - Depr. exp. ...

[Net inc: (Incorrect bal. - Depr. exp. ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The expense recognition principle states that expenses

Q23: The income statement is an important financial

Q43: Can financial statements be prepared directly from

Q104: The revenue recognition principle dictates that revenue

Q111: Bichon Company purchased equipment for $6,720 on

Q113: One part of eight adjusting entries is

Q114: Truffle Candies paid employee wages on and

Q148: A company's calendar year and fiscal year

Q190: The balances of the Depreciation Expense and

Q256: The fiscal year of a business is