Multiple Choice

The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

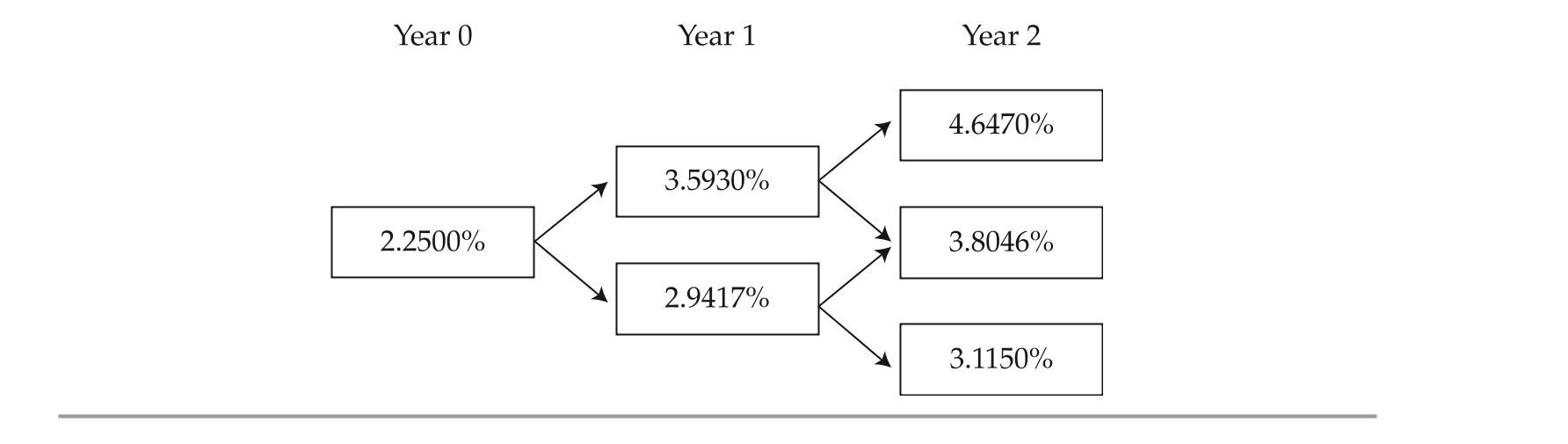

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-The conversion price of the bond in Exhibit 3 is closest to:

A) $26.67.

B) $32.26.

C) $34.19.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Based on Exhibit 4 and Gillette's forecast

Q10: Based on Exhibit 1, which key rate

Q11: Based on Exhibit 2, the current price

Q12: Based on Exhibit 3, the market conversion

Q13: if Smith's interest rate volatility forecast turns

Q15: if the Brown and Company forecast comes

Q16: The following information relates to Questions

Q17: The following information relates to Questions

Q18: The following information relates to Questions

Q19: The following information relates to Questions