Multiple Choice

The following information relates to Questions 16-29

-The swap spread is quoted as 50 bps. If the five-year uS Treasury bond is yielding 2%, the rate paid by the fixed payer in a five-year interest rate swap is closest to:

A) 0.50%.

B) 1.50%.

C) 2.50%.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: What is the TEd spread and what

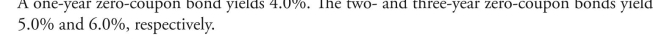

Q2: Given spot rates for one-, two-, and

Q3: Explain the strategy of riding the yield

Q4: The following information relates to Questions 49-57liz

Q5: The following information relates to Questions 16-29<br>

Q7: The following information relates to Questions 49-57liz

Q8: The following information relates to Questions 16-29<br>

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions 49-57liz