Multiple Choice

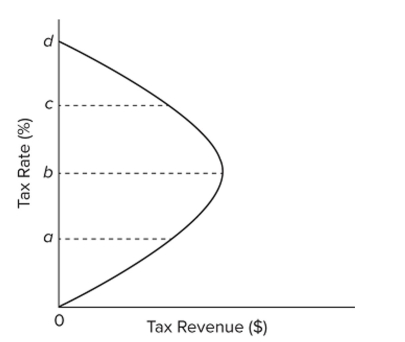

Refer to the graph. Critics of supply-side economics would argue that tax rates are currently between

Refer to the graph. Critics of supply-side economics would argue that tax rates are currently between

A) b and d and that a decrease in tax rates will decrease tax revenues.

B) 0 and b and that a decrease in tax rates will decrease tax revenues.

C) 0 and b and that a decrease in tax rates will increase tax revenues.

D) b and d and that a decrease in tax rates will increase tax revenues.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: In an aggregate demand-aggregate supply framework, fiscal

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" A) a decrease

Q57: Government can push the unemployment rate below

Q58: A stable Phillips curve does not allow

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q61: If the government uses expansionary, monetary, or

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q63: In the short run, output increases in

Q64: Suppose that the Consumer Price Index for