Multiple Choice

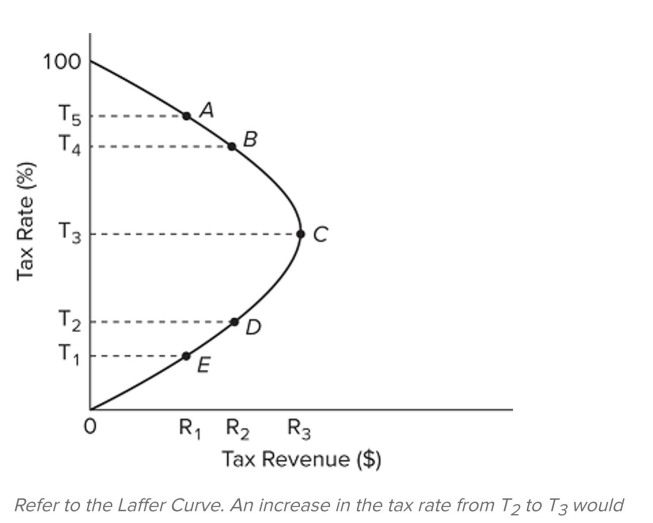

A) decrease tax revenues and support the views of supply-side economists.

B) increase tax revenues and support the views of supply-side economists.

C) increase tax revenues and support the views of mainstream economists.

D) decrease tax revenues and support the views of mainstream economists.

Correct Answer:

Verified

Correct Answer:

Verified

Q118: Explain the basic arguments for supply-side economics.

Q119: The inflation and unemployment data for the

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q121: Explain what happens in the extended aggregate

Q122: The adjustment mechanism that brings the economy

Q124: In the extended analysis of aggregate supply,

Q125: In the context of the Phillips curve,

Q126: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q127: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer

Q128: One criticism against supply-side cuts in marginal