Multiple Choice

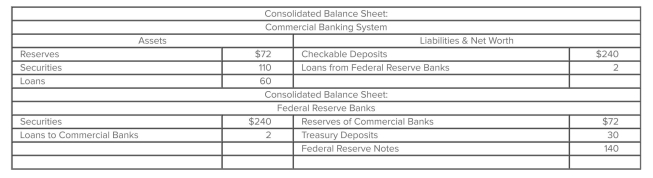

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money

A) will decrease by $2, but the money-creating potential of the commercial banking system will not be affected.

B) is not directly affected, but the money-creating potential of the commercial banking system will decrease by $8.

C) will directly increase by $2, and the money-creating potential of the commercial banking system will decrease by an additional $8.

D) will directly increase by $2, and the money-creating potential of the commercial banking system will increase by an additional $8.

Correct Answer:

Verified

Correct Answer:

Verified

Q325: The equilibrium rate of interest in the

Q326: The purchase of government securities from the

Q327: The main goal of quantitative easing (QE)

Q328: Open-market operations change<br>A) the size of the

Q329: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer

Q331: If severe demand-pull inflation was occurring in

Q332: As a result of policy actions taken

Q333: On a diagram where the interest rate

Q334: Suppose the demand for money and the

Q335: The fundamental objective of monetary policy is