Multiple Choice

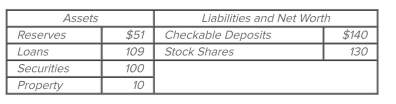

Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 30 percent. All figures are in billions. If the commercial banking system actually loans the maximum

Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 30 percent. All figures are in billions. If the commercial banking system actually loans the maximum

Amount it is able to lend,

A) reserves and deposits equal to that amount will be gained.

B) excess reserves will be $2.6 billion.

C) excess reserves will fall to $1.7 billion.

D) excess reserves will be reduced to zero.

Correct Answer:

Verified

Correct Answer:

Verified

Q182: Banks' borrowed funds come mostly from<br>A) buying

Q183: A bank's checkable deposits shrink from $40

Q184: Describe the basic features of a commercial

Q185: If a bank has excess reserves of

Q186: <span class="ql-formula" data-value="\begin{array} { | l |

Q188: Balance sheets always balance because reserves must

Q189: Which of the following transactions has the

Q190: A bank is in the position to

Q191: What is meant by the "federal funds

Q192: The monetary multiplier can also be called