Multiple Choice

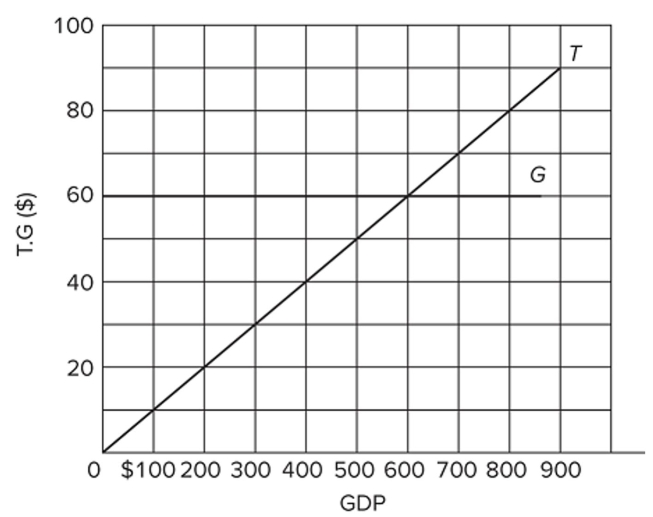

Refer to the diagram, where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment and actual GDP are each $400 billion, government can balance

Refer to the diagram, where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment and actual GDP are each $400 billion, government can balance

Its cyclically adjusted budget by

A) increasing T by $40 billion.

B) reducing G by $20 billion.

C) reducing T by $20 billion.

D) increasing T by $10 billion and reducing G by $20 billion.

Correct Answer:

Verified

Correct Answer:

Verified

Q195: If taxation becomes more progressive, the built-in

Q196: Suppose the federal government had budget deficits

Q197: The American Recovery and Reinvestment Act of

Q198: The crowding-out effect suggests that<br>A) tax increases

Q199: Discretionary fiscal policy will likely cause budget<br>A)

Q202: The impact of an expansionary fiscal policy

Q203: Which of the following fiscal policy actions

Q204: A contractionary fiscal policy shifts the aggregate

Q205: The actual budget may be in deficit

Q366: If the budget deficit becomes smaller, then