Multiple Choice

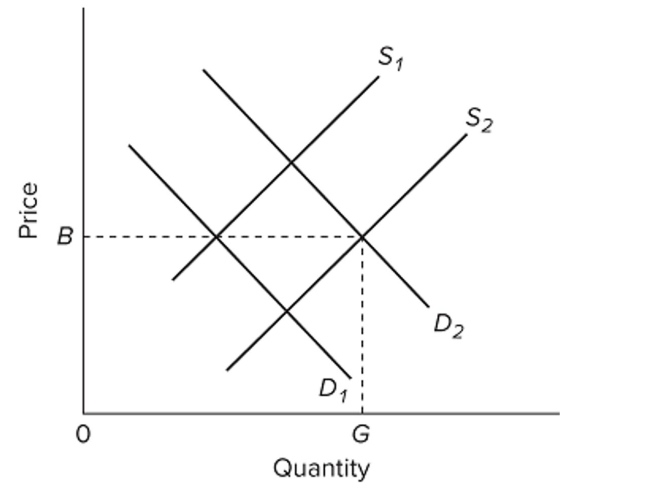

Refer to the competitive market diagram for product Z. Assume that the current market demand and supply curves for Z are D2 and S2. If there are substantial external costs associated with the

Refer to the competitive market diagram for product Z. Assume that the current market demand and supply curves for Z are D2 and S2. If there are substantial external costs associated with the

Production of Z, then

A) a price lower than B and an output greater than G would improve resource allocation.

B) government should levy a per-unit excise tax on Z to shift the demand curve to the right.

C) government should levy a per-unit excise tax on Z to shift the supply curve toward S1.

D) government should subsidize the production of Z to lower equilibrium price and increase equilibrium output.

Correct Answer:

Verified

Correct Answer:

Verified

Q211: (Consider This) When you enter a congested

Q212: An efficiency loss (or deadweight loss)<br>A) is

Q213: The socially optimal amount of pollution abatement

Q214: Pigovian taxes<br>A) are used to correct negative

Q215: What are the limitations to government's role

Q217: According to the Coase theorem, externality problems<br>A)

Q218: Production subsidies are a way of internalizing

Q219: One consequence of the asymmetric-information problem in

Q220: (Consider This) The principle that private negotiation

Q221: eBay, Amazon, and other Internet shopping sites