Multiple Choice

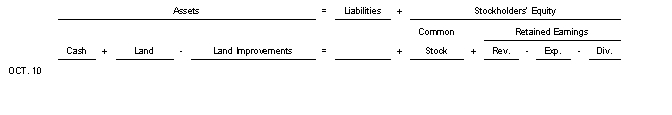

On October 10 Givens Retail purchased a parking lot for cash of $360000.The cost of the land was $175000.The paving cost $125000 and the lights to illuminate the new parking area cost $60000.Use the following tabular analysis to record the transaction.

A) Increase Land and decrease Cash $360000.

B) Increase Land $175000 increase Land Improvements $185000 and decrease Cash $360000.

C) Increase Land $300000 increase Land Improvements $60000 and decrease Cash $360000.

D) Increase Land Improvements and decrease Cash $360000.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A gain or loss on disposal of

Q35: All of the following statements are false

Q84: On July 1 2022 Dylan Company purchased

Q87: The return on assets indicates how efficiently

Q94: In computing depreciation salvage value is<br>A) the

Q112: On May 1, 2022, Irwin Company purchased

Q163: Schrock Company purchases a new delivery van

Q220: Recording depreciation each period is an application

Q276: All plant assets (fixed assets) must be

Q290: The cost of an intangible asset with