Multiple Choice

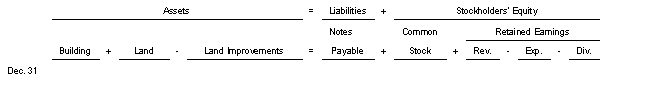

On August 7 Gideon Ridge Restaurant purchased a building in exchange for a note with a face amount of $1660000.The cost of the land was $600000.The building cost $900000 and the parking lot was valued at $160000.Use the following tabular analysis to record the transaction.

A) Increase Building and increase Notes Payable $1660000.

B) Increase Land $600000 increase Land Improvements $160000 increase Building $900000 and increase Notes Payable $1660000.

C) Increase Land $600000 increase Land Improvements $160000 increase Building $900000 and decrease Notes Payable $1660000.

D) Increase Building $760000 increase Land $600000 and increase Notes Payable $1660000.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A change in the estimated salvage value

Q29: Research and development costs that result in

Q36: Machinery was purchased for $340,000 on January

Q135: On October 1 2022 Mann Company places

Q136: Newell Company purchased a machine with a

Q137: During 2022 Hernandez Company incurred $1900000 of

Q182: An asset was purchased for $400,000.It had

Q191: All of the following statements regarding impairments

Q229: The IRS does not require the taxpayer

Q234: When an entire business is purchased goodwill