Multiple Choice

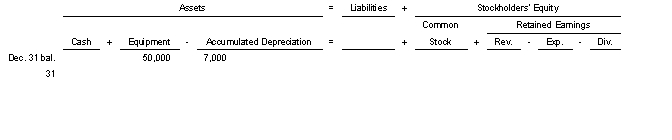

On Nov 2 2020 MG Company purchased equipment with $50000 cash.The equipment has an estimated salvage value of $8000 an estimated life of 7 years and is depreciated by the straight-line method.Use the following tabular analysis to determine the book value of the equipment at December 31 2022.

A) $50000.

B) $43000.

C) $37000.

D) $32000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The book value of a plant asset

Q25: Which of the following is not true

Q26: If an acquired franchise or license is

Q29: Once cost is established for a plant

Q50: Mitchell Corporation bought equipment on January 1,

Q71: Morton's Courier Service recorded a loss of

Q93: Which of the following is not properly

Q98: The Accumulated Depreciation account represents a cash

Q107: Mitchell Corporation bought equipment on January 1,

Q258: The cost of a patent should be