Multiple Choice

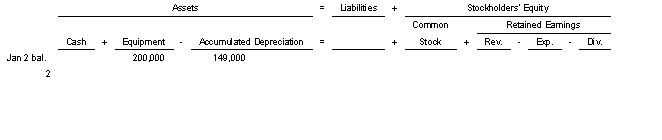

On January 2 2022 Feldman Corporation sold equipment with a book value of $51000 for $33000 cash.Use the following tabular analysis to record the sale.

A) Increase Cash $33000 decrease Equipment $200000 decrease Accumulated Depreciation $149000 and decrease Revenues $14000.

B) Increase Cash $33000 decrease Equipment $200000 and decrease Accumulated Depreciation $149000.

C) Increase Cash $33000 decrease Equipment $200000 decrease Accumulated Depreciation $149000 and increase Expenses $14000.

D) Increase Cash $33000 decrease Equipment $51000 and increase Expenses $14000.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Which of the following is <b>not</b> considered

Q32: The book value of an asset is

Q54: A loss on disposal of a plant

Q103: The cost of an intangible asset must

Q172: A loss on disposal of a plant

Q174: An asset was purchased for $140,000.It had

Q174: Capital expenditures are expenditures that increase the

Q175: The cost of successfully defending a patent

Q176: On January 2 2022 High Country Corporation

Q179: A computer company has $4000000 in research