Multiple Choice

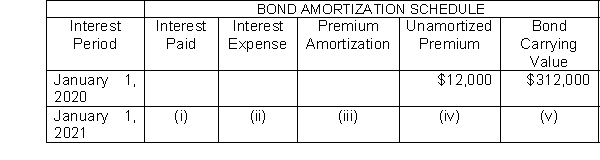

Presented here is a partial amortization schedule for Roseland Company which sold $300,000 of 5-year, 10% bonds on January 1, 2020, for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (i) ?

Which of the following amounts should be shown in cell (i) ?

A) $31,200

B) $32,400

C) $30,000

D) $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q110: Discount on bonds is an additional cost

Q111: If bonds are issued at a premium,

Q112: Hardy Company has current assets of $95,000,

Q113: With an interest-bearing note, the amount of

Q114: If bonds have been issued at a

Q116: The debt to assets ratio is computed

Q117: A $600,000 bond was retired at 98

Q118: Companies with good credit ratings use _

Q119: Farris Company borrowed $800,000 from BankTwo on

Q120: Aire Corporation retires its bonds at 106