Multiple Choice

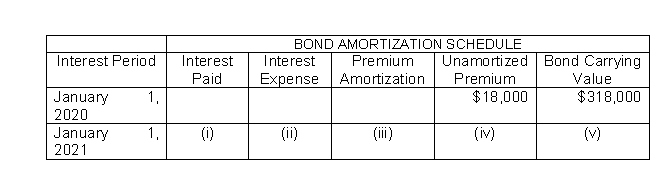

Presented here is a partial amortization schedule for Rosebud Company which sold $300,000 of 5-year, 10% bonds on January 1, 2020, for $318,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (iii) ?

Which of the following amounts should be shown in cell (iii) ?

A) $9,000.

B) $18,000.

C) $3,600.

D) $1,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q143: The relationship of current assets to current

Q144: The carrying value of bonds at maturity

Q145: All bonds will always fall into which

Q146: The entry to record the payment of

Q147: The higher the sales tax rate, the

Q149: A mortgage note payable with a fixed

Q150: Oakley Company does not ring up sales

Q151: The contractual interest rate is always stated

Q152: If $800,000, 6% bonds are issued on

Q153: Interest expense on a note payable is