Multiple Choice

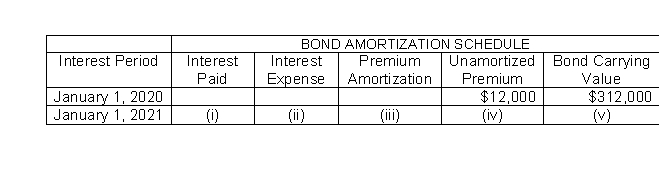

Presented here is a partial amortization schedule for Roseland Company which sold $300,000 of 5-year, 10% bonds on January 1, 2020, for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (v) ?

Which of the following amounts should be shown in cell (v) ?

A) $314,400

B) $313,200

C) $309,600

D) $310,800

Correct Answer:

Verified

Correct Answer:

Verified

Q196: A company whose current liabilities exceed its

Q197: The board of directors may authorize more

Q198: Kingery Sales Company has the following selected

Q199: A bond discount must<br>A)always be amortized using

Q200: Current liabilities are expected to be paid

Q202: Each bondholder may vote for the board

Q203: The times interest earned is computed by

Q204: A long-term note that pledges title to

Q205: Stockholders of a company may be reluctant

Q206: Gains and losses are not recognized when